In this trade blog, B+LNZ's Senior Trade Policy Advisor Nicholas Jolly discusses the ‘Barriers to Trade’ report, released in June this year, brings us up to date on the current state of play and looks at where to from here.

After a bit of a hiatus, we are looking to get these trade blogs out more often. Please share your feedback and let us know what you are interested in hearing more about. Email Nicholas at: [email protected].

The Barriers to Trade Report

In June this year, B+L NZ and Meat Industry Association (MIA) released the biennial Barriers to Trade 2023 report. It highlighted the success of the red meat sector through the challenging COVID-19 period, where global trade had been impacted by a multitude of factors such as port closures, increased non-tariff barriers imposed by our trading partners, labour shortages, and shipping availability. While these factors ultimately reduced overall returns, the sector posted its best-ever result with $11.8 billion worth of exports.

Current state of play

During 2022, we paid $197 million in tariffs, the majority of this on beef to two markets, South Korea, and Japan, both of which we have free trade agreements (FTAs) in place with. Through the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), we will see Japanese tariffs on New Zealand beef drop from a starting point of 38.5 per cent down to 9 per cent in 2033 – they are currently at 23.3 per cent.

The NZ-South Korea FTA will reduce tariffs from a starting point of 40 per cent down to 0 per cent in 2029, currently they are at 16 per cent in 2023.

We already had good access to the EU and the UK for sheepmeat, but the signing of the UK FTA has delivered comprehensive access for beef, and the EU FTA, when implemented next year, will provide some limited but valuable beef access, slowly improving over the next seven years.

In the US market, we have preferential access through historical agreements, which provide better opportunities for New Zealand beef compared to our competitors. This gives us access to a 213,408-tonne quota with an in-quota tariff of 4.4c per kg, while our competitors based in South America have access to much smaller quotas of around 20,000 tonnes. Any US imports above the quota pay a tariff of 26.4 per cent. Mexico, Canada, and Australia have FTAs with the US and so pay 0 per cent.

B+LNZ and MIA continue to support the New Zealand government in its FTA negotiations with the Gulf Cooperation Council (Saudi Arabia, Kuwait, the United Arab Emirates (UAE), Qatar, Bahrain, and Oman) where tariffs of up to 15 per cent remain on some products. The New Zealand government is also negotiating a separate bilateral FTA with the UAE.

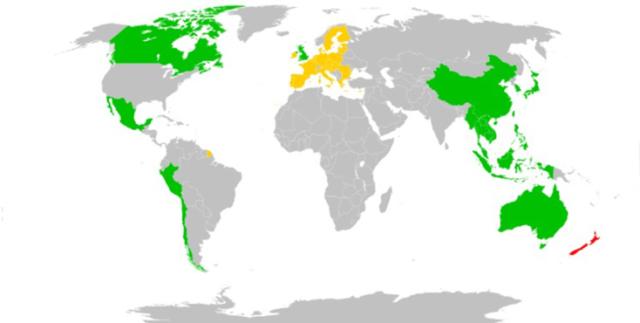

Looking at the trade landscape, the hard work of previous B+LNZ and MIA trade policy teams supporting the New Zealand government is paying off. We have FTAs with the majority of the countries we export too, and once the FTA with the European Union is implemented 86 per cent of our exports will be covered some sort of trade agreement.

Current FTA markets shown in green; EU signed FTA (but not yet in force) shown in yellow.

These agreements will progressively reduce tariffs over time and continue to deliver benefits to farmers. Our network of FTAs provides flexibility and resilience in case of something happening to one of our trading partners. During the COVID-19 pandemic, this flexibility was invaluable as exporters were able to shift product between markets as ports closed or reduced capacity due to the pandemic.

Where to from here?

The focus of our trade policy now turns to focussing on non-tariff barriers (NTBs), which were estimated to cost the red meat sector $1.5 billion in 2019. These NTBs cover a range of issues and are difficult to address, however our FTAs do offer some avenues to help with this. Common NTBs include:

- Onerous premises audits and registrations

- Complex and inconsistent halal requirements

- Lack of transparency of requirements

- Inconsistent technical requirements

- Onerous or unnecessary certification

- Prescriptive and arduous labelling requirements

- Inefficient import checks

- Consularisation of documentation

- Private standards.

Looking forwards, we will work with the Government to identify and tackle these NTBs across our export markets. We cannot go backwards and in the face of rising global protectionism we must ensure that the access we have fought for is not reduced. There are also future opportunities for new markets such as India, and longer term in Africa as their middle class grows and demand for high quality red meat increases.

With over 90 per cent of the red meat sector’s production exported to over 120 countries around the world, trade policy will continue to be a crucial focus for B+LNZ.